Our last article covering 10-year U.S. Treasuries discussed an investment idea that was motivated by lower yield expectations. The assessment proved correct as the 10-year bond gained more than 10% since February. This write-up shows that an outlook for long-dated bonds became tricky from here on. Therefore, we cashed in our positions that were motivated on the February 7th analysis.

Source: Global Financial Data

Long-dated bonds are showing symptoms of a bubble. Valuations indicate little chance of positive real return and buyers base their case on central banks. The U.S. Treasury bond yields are below the lows that have been witnessed throughout seven centuries of bond data. Global Financial Data has put together an index of government bond yields stretching back seven centuries. This index in the very first chart uses government bond yields from the leading economic powers of each century to measure the long-term changes in government bond yields. These include Italian, Dutch, English, and U.S. government bonds. The chart puts today’s situation into a historical perspective and reveals that we live in genuinely unique times. Today, we can witness how entire yield curves of Western European countries turned negative up to 30-year maturities. The purchaser of such bonds speculates on price increases as a means of income only. A long-term perspective shows that something is extraordinary in comparison to seven centuries of government bond price data.

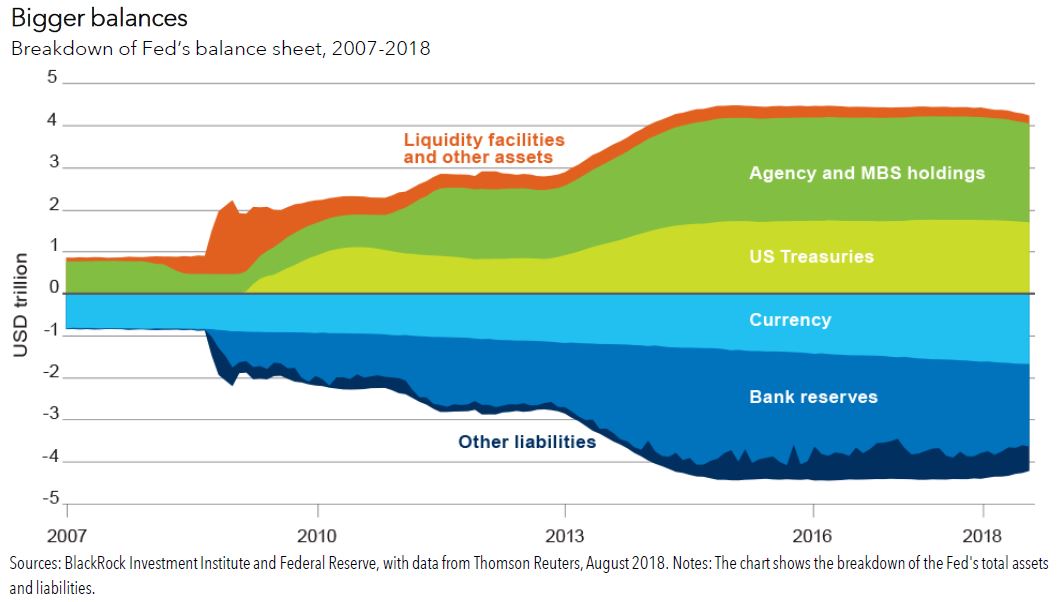

Sources: Blackrock, Federal Reserve, and Thomson Reuters

A fundamental explanation for the contemporary situation is probably the asset purchase activity of central banks in industrial countries. The asset purchase programs of the central banks led to an accumulation of government bonds and other securities as the Fed’s and ECB’s balance sheet charts show. The programs started during the Global Financial Crisis ten years ago. They have not been unwound yet. A yield reversal to the upside will occur eventually. The main question is when. We will tackle this topic in an interdisciplinary approach.

Source: Nordea Markets and Macrobond

Behavioral evidence reveals an optimistic sentiment and elevated speculative allocations at the time of this write-up. Investors believe that long-dated bonds are a promising investment and channeled liquidity accordingly. The COT report in the time-series chart below shows that speculative positions reached elevated levels in the 30-year bond. Those levels coincided with some form of correction during the past eight years. Yields rebounded to the upside before resuming their paramount trend down. 10-year yields are correlated to the 30-year rates. Hence, the behavioral approach sends a contrarian signal. Nevertheless, it is essential to note that sentiment and positioning can remain elevated for several weeks while the trend carries on.

Source: Freecotdata.com

The technical picture shows a clear downtrend, even though price action broke below the orange channel and diverged lately. The entire drop from last year’s recovery high counts best as a three-wave trend. Two scenarios are likely and point towards different directions. The most likely scenario is some form of sideways correction, which resolves in a final spike to the downside. This scenario is depicted in black. However, there is also a non-negligible probability for another scenario, which implies that the bond rally finished. A sustained break of 1.8% to the upside would shift odds towards a long-term trend reversal. Nevertheless, technical evidence is ambiguous at this junction. Most often, it proved correct to respect the paramount trend in similar situations.

Source: Tradingview and ESI Analytics Ltd

The bottom line is that Treasury bond yields are exceptionally low from a historical perspective. Nevertheless, there is not enough evidence that a secular trend towards lower yields ended already. Western European countries provide the best example that yields can turn negative. Investors do not price any credit risk and renounce on interest payments is that case. It is a situation that is unlikely sustainable. A yield reversal will have the most significant impact on prices of long-dated bonds because these are most sensitive to yield changes.

Published 29/08/2019