Stocks continue to behave unintuitively for most investors as a bubble inflates. We’ve shown various valuation metrics in the past few write-ups here. Fundamentals have not changed as valuations remain stretched and not sustainable. Nonetheless, we made a case to buy equities short-term. The environment remains probably constructive for equities until year-end. However, the risk/reward relationship is not as good as it was a few weeks ago.

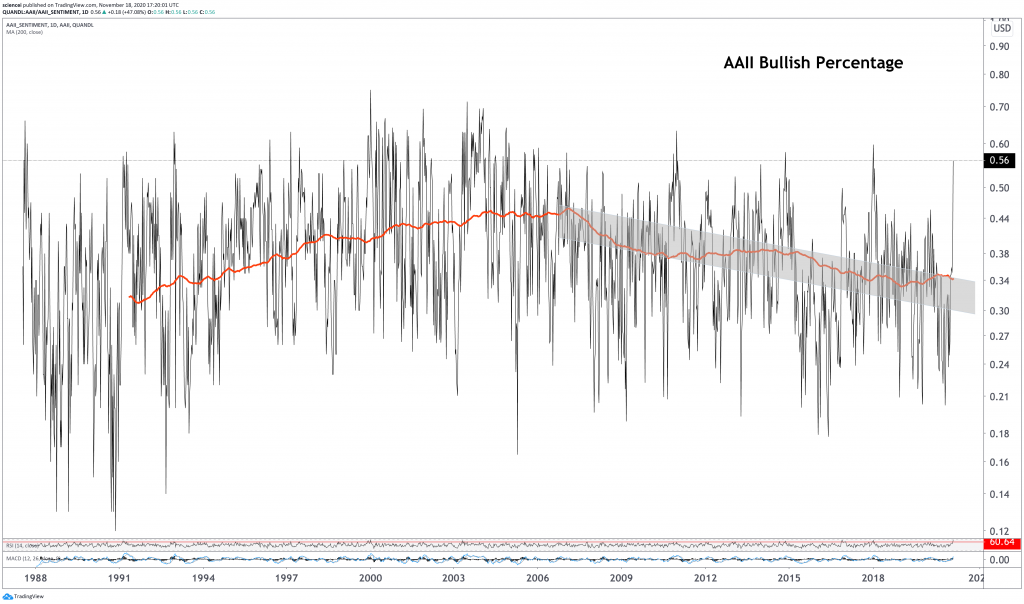

The reasoning behind our short-term bullish case was a combination of technicals, seasonality, investor behavior, and likely positive surprises from a corona vaccine. All factors proved correct already. Consequently, US equities had their best start on record for November. The S&P 500 rallied impulsively and overseas indices confirmed the bullish price action. Investors probably de-risked their position too much in anticipation of the US election. Several sentiment gauges show how expectations softened into October. It appears as if many market participants held a “wait and see” stance. Eventually, they were caught unprepared by the substantial advance and had to chase the rally. The AAII investor sentiment above shows a bullish spike in expectations. It got confirmed by fund flows, which printed the largest inflows in more than 20 years.

The bullish trend is probably still intact and likely to persist as long as 3325 does not break down sustainably. The strength of the past few trading days was remarkable, even relative to the past decade. It signals residual buying demand from those that could not get into the market. Nonetheless, profit-taking is likely to lead to a short-term pullback before the rally carries on. The base case remains that a pullback in the S&P 500 reverses near or above 3325 and carries on into year-end.

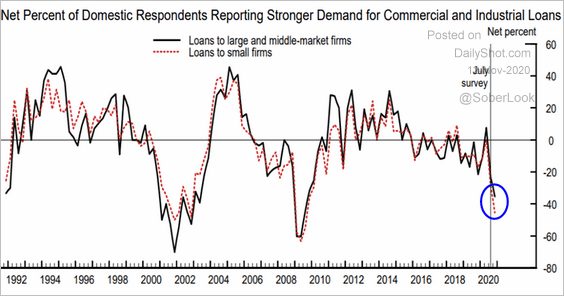

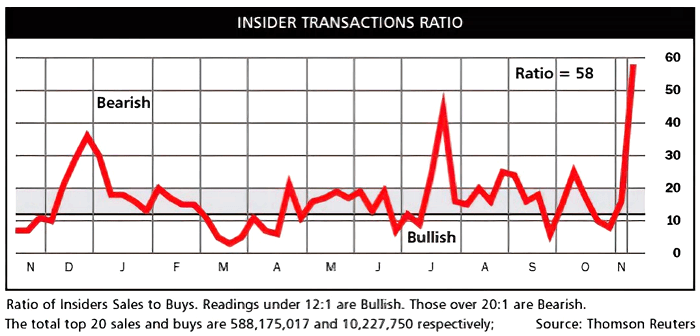

The bubble will probably inflate further until it pops. A loud pop is more likely in early 2021 than in late 2021 because the stock market completely decoupled from the economy. Admittedly, the stock market is a leading indicator. Nonetheless, a few other macroeconomic variables signaled a recovery in tandem or even earlier than the stock market historically. Lending demand is among these variables. However, it has deteriorated lately and traffic trackers in Western economies confirmed that negative economic outlook. Not surprisingly, control persons (significant equity ownership) lighten up on their equity holdings and The Insider Transactions Ratio charted below reached into bearish territory. Insider sentiment is, contrary to investor sentiment, a conformist and not a contrarian indicator. Hence, either the stock market or the leading indicators will prove incorrect.

Moreover, there’s another factor that is endangering the recovery – the Covid-19 vaccine. As paradoxical as it might sound, people are likely to be less cautious because of a “cure” on the horizon. Many are tired of lockdowns and want to go back to normal. Moreover, the timing is another factor as winter approaches and activity shifts indoors. Meanwhile, infections are accelerating in most Western economies. This probably leads to either an escalating health situation or another wave of hard lockdowns in the West. Both possibilities are harmful to the economy and could be the catalyst that strikes a knock-out punch to the 2020 bull run.

The bottom line is that the stock market is likely to rally towards 3900-4000 before the wheels come off.