Excessive levels of investor sentiment are associated with subsequently surprising asset returns to the opposite direction of expectations.

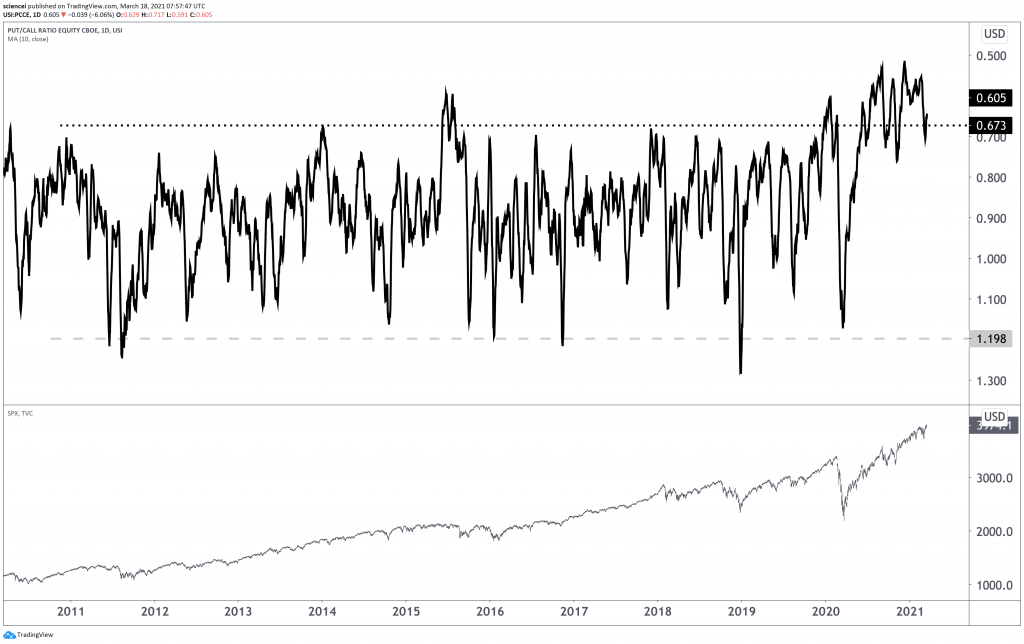

The moving average of the CBOE Put/Call ratio charts this relationship over the past decade.

The current setting has not only recorded excessive levels of sentiment. Moreover, the environment has been remarkably positive for an exceptionally long period. The put/call ratio gauge reached the extreme territory in June 2020 and persisted at excessive levels.

A risk-on mentality has never been so prevalent for such a long period throughout the past decade.