Paul Samuelson famously stated that the stock market had predicted nine of the past five recessions. It’s a remark that is often repeated to mock the predictive accuracy of the stock market for the economy. Nonetheless, both move together. There were more than twenty recessions recorded by the National Bureau Of Economic Research in the past 170 years. All of them led to a bear market in equities. However, the stock market did not need recessions to correct significantly. It often recorded 10% – 20% slumps even during economic expansions. The 1987 crash is probably the most prominent example. A sharp correction unfolded back then despite the constructive economic picture. Subsequently, the correction was retraced swiftly within the next few months. Equities might set the stage for a similar scenario currently: A sharp correction despite constructive economic fundamentals.

Fundamentals Remain A Mixed Bag

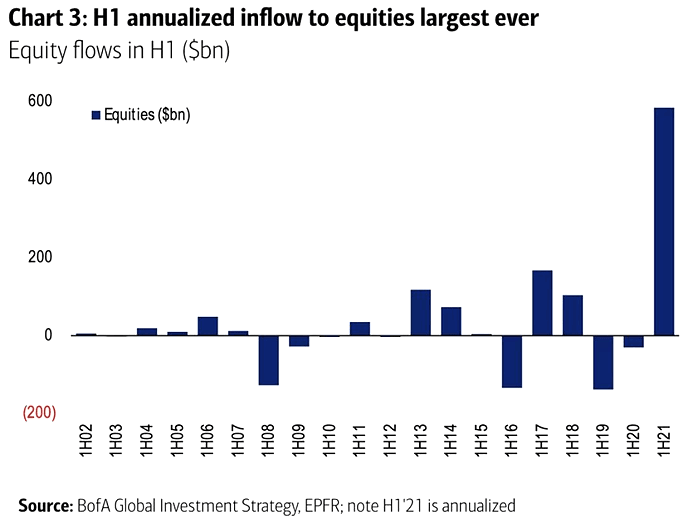

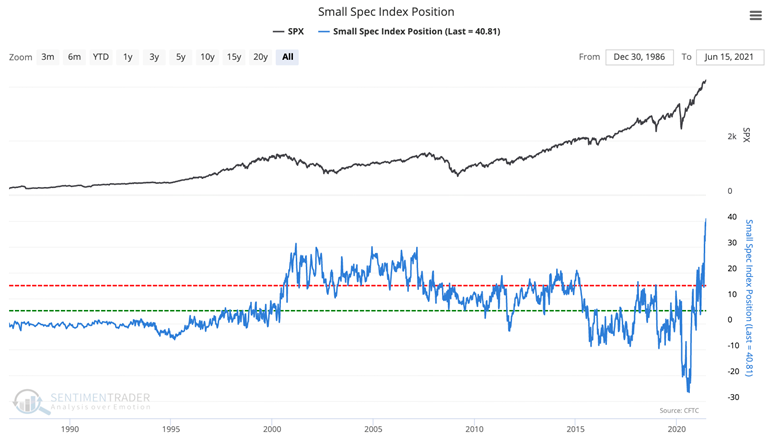

Equities remain very expensive. Nonetheless, record-high valuations did not prevent investors from pouring liquidity into the stock market recently. H1/2021 has been a record-breaking half in terms of liquidity inflow as the Bank of America chart reveals. The data confirms various other liquidity flow and positioning gauges. Everybody is participating in the stock market as each cohort is invested heavily. Nonetheless, retail investors remain most upbeat. Sentiment trader shows the relative participation of small speculators that are invested in stocks. Their metric went from one extreme to another as small investors went all-in after the corona crisis.

The speculative excess persisted remarkably long. Investors turned optimistic one year ago. Overall sentiment remained positive and reached into extreme territory subsequently. All Star charts show the relative duration of investors’ optimism as measured by the AAII Bulls survey. More than 20 weeks of optimistic sentiment among investors was rare during the past 16 years. Currently, we record optimistic sentiment for more than 50 weeks. That has never been the case in the past two decades. Option-based sentiment gauges confirm that observation.

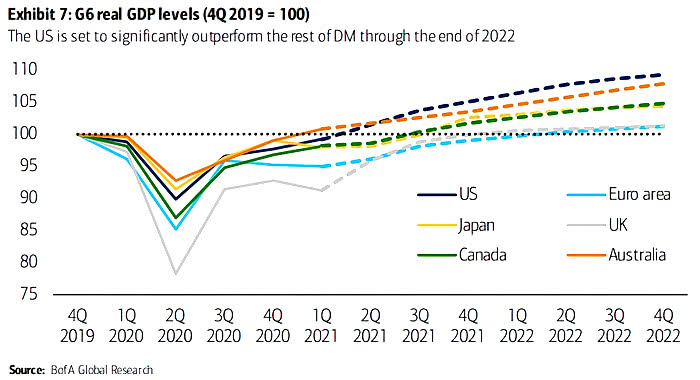

Nonetheless, the economic recovery is unlikely to end despite the speculative excesses in the market and record high valuations. Leading economic indicators remain constructive and a headwind for stocks from the economy is unlikely short-term. The Australian and US economies recovered relatively well into Q1/2021 whereas Europe and Japan lost momentum. Recent economic numbers confirmed a slowdown in the largest European economies. The economic picture shows typical late-cycle characteristics for the pandemic recovery. Yet, there are no recessionary pressures evident.

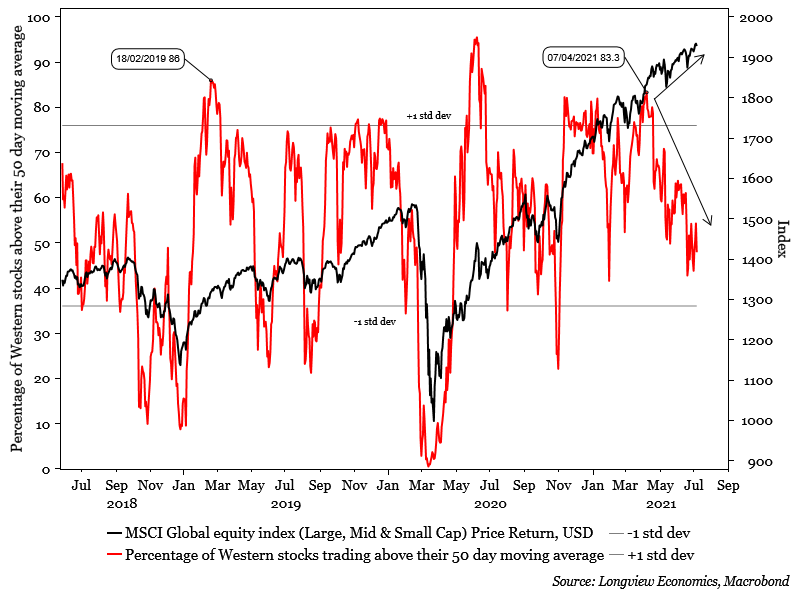

Technicals Signal A 5%-10% Correction

Broad-based momentum led equities into Spring. Tech remains in the driving seat and drags the S&P 500 along. Meanwhile, the S&P 500 heads into a big resistance at 4380-4400. However, buying demand weakened as strength indicators show. Equities diverge across Western markets. That happened despite exuberant sentiment that led indices into the most recent all-time highs. The chart from longview economics shows that fewer stocks participate and fail to confirm a broad-based advance into all-time highs. Fading strength across equity markets typically signals at least a 5%-10% correction.

Conclusion

Equity valuations are similar to the tech bubble in 2000. Speculative positioning is buoyantly off the record and likely to sink the boat temporarily. Speculators tended to leave the ship as swiftly as they hopped on historically. However, the ship is probably not going to sink immediately. The economy has not sent alarming signals and lets stocks stay on course. Moreover, momentum has not been weak for long enough yet. There is even a case to buy-the-dip for short-term oriented swing traders if we see a material pullback during the next few days. Nonetheless, a subsequent summer rally is most likely setting the stage for humbling bulls during Autumn. All in all, an increasing amount of evidence adds up and could set the stage for similar market conditions as in 1987.