There are tons of long-term studies on international equities that arrive at similar conclusions. An important finding is that equities yielded on average roughly 8-9% p.a. over a long-term time frame. This implies that global equity investors doubled their money approximately every 8-9 years over the past century. Moreover, researchers noted that equities protected against inflation in the medium- to long-run. International datasets show that the conclusion above held generally as results were similar across countries. An excellent place to dig deeper into this subject are the following academic papers:

- Dimson, Elroy and Marsh, Paul and Staunton, Mike, Equity Premia Around the World (October 7, 2011)

- Arnott, Robert D. and Bernstein, Peter L., What Risk Premium is ‘Normal’? (January 10, 2002). Financial Analysts Journal, Vol. 58, No. 2, March/April 2002, pp. 64-85

- Ibbotson, Roger G. and Chen, Peng, Stock Market Returns in the Long Run: Participating in the Real Economy (March 2002). Yale ICF Working Paper No. 00-44

- Shiller, Robert J. (2000). Irrational Exuberance. Princeton University Press. ISBN 1400824362

Most of us are probably aware that U.S. American equities performed well throughout history, but it may be new that most overseas markets performed similarly well. However, evidence from financial data also reveals some devastating episodes that equity investors experienced during the past couple of centuries. The most famous three are probably:

- The nationalization of Eastern Bloc countries and China resulted in a total equity loss, which never recovered.

- Austrian “Gründerkrach of 1873” led to a 99% loss, which most equity investors never recovered.

- German equities lost 99% of their value during WWI and the subsequent hyperinflation, which took almost 50 years to recover.

The three examples above are admittedly extreme, but there have been more than two handfuls of other dramatic events during the past couple of decades. Those recorded broad-based losses of more than 75% in equity capital. Moreover, investors that were affected by such events frequently took more than 20 years to recover their capital to pre-crisis levels. The incidents that happened throughout the world and Western economies were mostly affected during the Great Depression around 1929-1932. Secular bear markets are certainly not something that belongs inside dusty history books because they are an artifact of the past. They can happen today as well, and the financial crisis in 2007-2009 is the most recent example that recorded broad-based declines of close to 60% in U.S. equities. Another recent example is Japan, which currently ranks as the third-largest economy in the world. Japanese equity investors have not recovered their losses until today if they invested around the all-time high in 1989. Similarly, those who invested in European blue-chips have been trapped in a secular sideways correction and lost money in real terms (inflation-adjusted) since early 2000. The key takeaway from long-term financial datasets is that equities are not only rewarding but also risky during specific periods. Those periods can last multiple decades and not everybody can afford to sit through such large drawdowns. The good news is that research unveils some possibilities to mitigate the risk of getting caught in a secular meltdown.

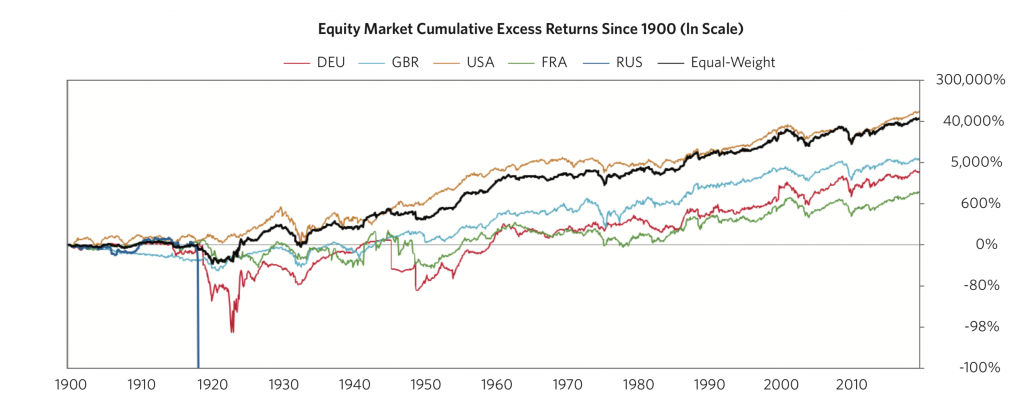

An evidence-based approach shows the benefits of geographic equity diversification. A basket of 12-20 global equity indices will mitigate extreme events and reduce volatility. The chart above illustrates the benefits of global equity diversification and shows an equally-weighted portfolio, which is rebalanced annually. The most interesting detail is that the basket performed on par with the U.S. market even though it included Russian and German equities. Russian equities resulted in a total loss, and German equities lost 99% of their value as already discussed above. Both events derailed the globally diversified portfolio for a few years only but had no material impact over the medium to long term. Therefore, it is not surprising that globally diversified equity investments are best-practice among industry leaders. It is a core principle of building and maintaining wealth long term. Yet, the vast majority of retail portfolios are geographically concentrated, which is well-known as the home bias puzzle.

Home bias is suboptimal from a long-run investing perspective. Advisors and retail investors can implement best-in-class portfolio diversification at low cost. Regulated ETFs track broad-based equity indices of the 20 largest economies at a low cost. Adding them to any retail portfolio is simple and does not involve much more time apart from setting the portfolio up and rebalancing it annually in roughly equal weights.

A globally diversified portfolio with equal country allocations had some attractive characteristics historically. It roughly doubled the invested money every nine years over the past few decades. Moreover, the aggregate portfolio protected to some extent against extreme events and decades of country-specific stagnation. Capturing these positive characteristics did not require any forecasting of crises as long as the portfolio was rebalanced roughly to equal weights annually. Nonetheless, long-term evidence shows that even a globally diversified portfolio remains vulnerable to particular events – global financial crises. These occurred significantly less often than regional crises but had a large impact on portfolios that consisted of equities only regardless of international diversification.