Rules

- A diagonal subdivides into 5 waves

- Wave 2 cannot retrace more than 100% of wave 1

- Wave 3 cannot be the shortest of the three action waves, 1,3, and 5

- Wave 3 always goes beyond wave 1

- A diagonal appears only as wave 1(leading) or 5(ending) of an impulse or as wave A(leading) or C(ending) of a zigzag

- All 5 subwaves of an ending diagonal are decomposed in zigzags

- Waves 2 and 4 of a leading diagonal are decomposed in zigzags

- Wave 4 never moves beyond the end of wave 2

- Wave 4 always overlaps wave 1

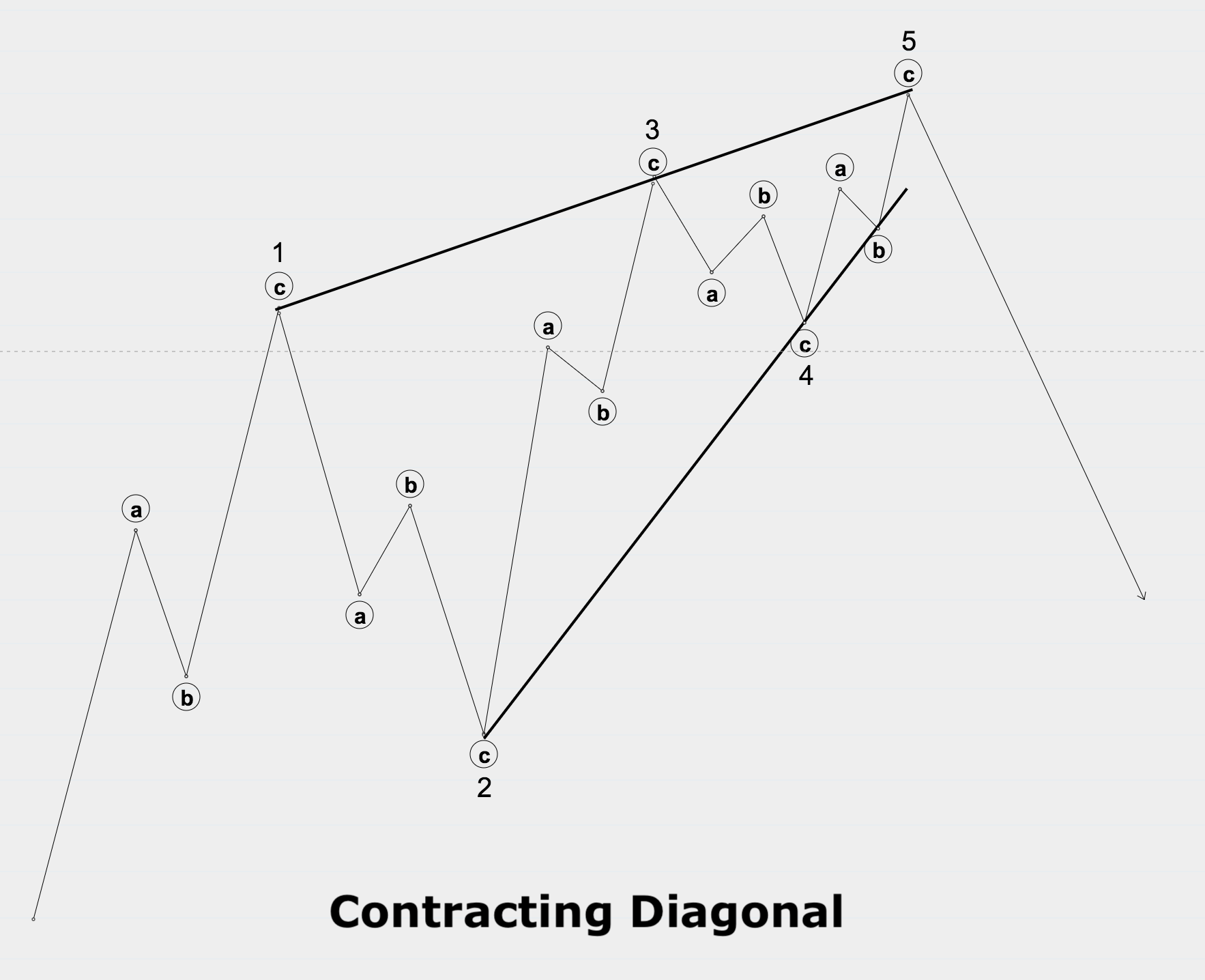

- Contracting diagonals have always a shorter 3rd wave relative to their 1st wave

- Contracting diagonals have always a shorter 5th wave relative to their 3rd wave

- Contracting diagonals have always a shorter 4th wave relative to their 2nd wave

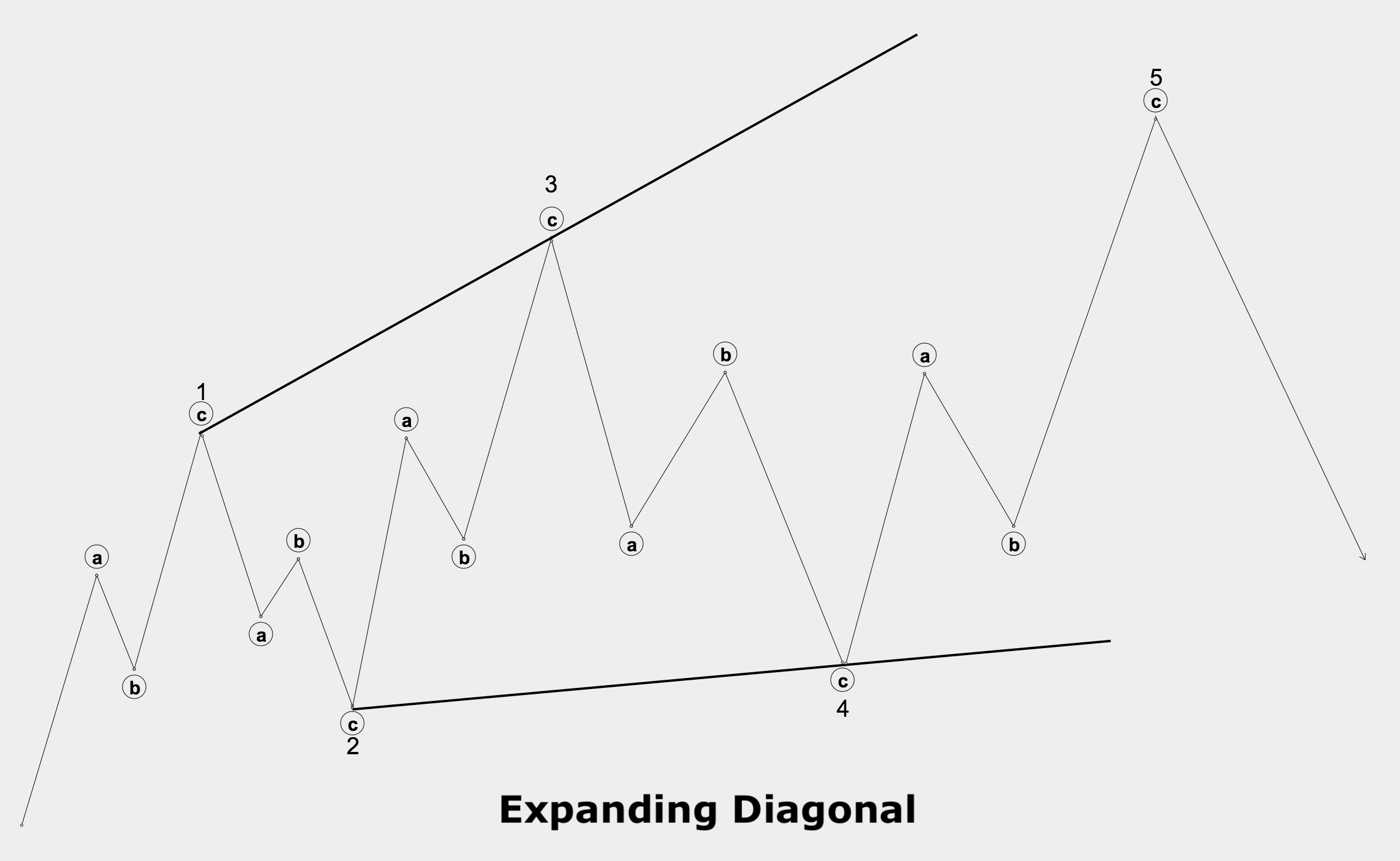

- Expanding diagonals have always a longer 3rd wave relative to their 1st wave

- Expanding diagonals have always a longer 5th wave relative to their 3rd wave

- Expanding diagonals have always a longer 4th wave relative to their 2nd wave

- A leading, as well as an expanding diagonal, is never truncated

-

Guidelines

- Diagonal occur because of transitory forces of trend changes act against each other

- Waves 2 and 4 retrace a great proportion (at least 50%) of their preceding wave

- Ending diagonals are rare

- Generally, count diagonals in real-time once wave 4 is almost complete

- Sometimes the zigzags may subdivide further into double zigzags

- Ending diagonals usually cause substantial reversals

- Expanding leading diagonals appear sometimes at the start of stock market declines