Rules

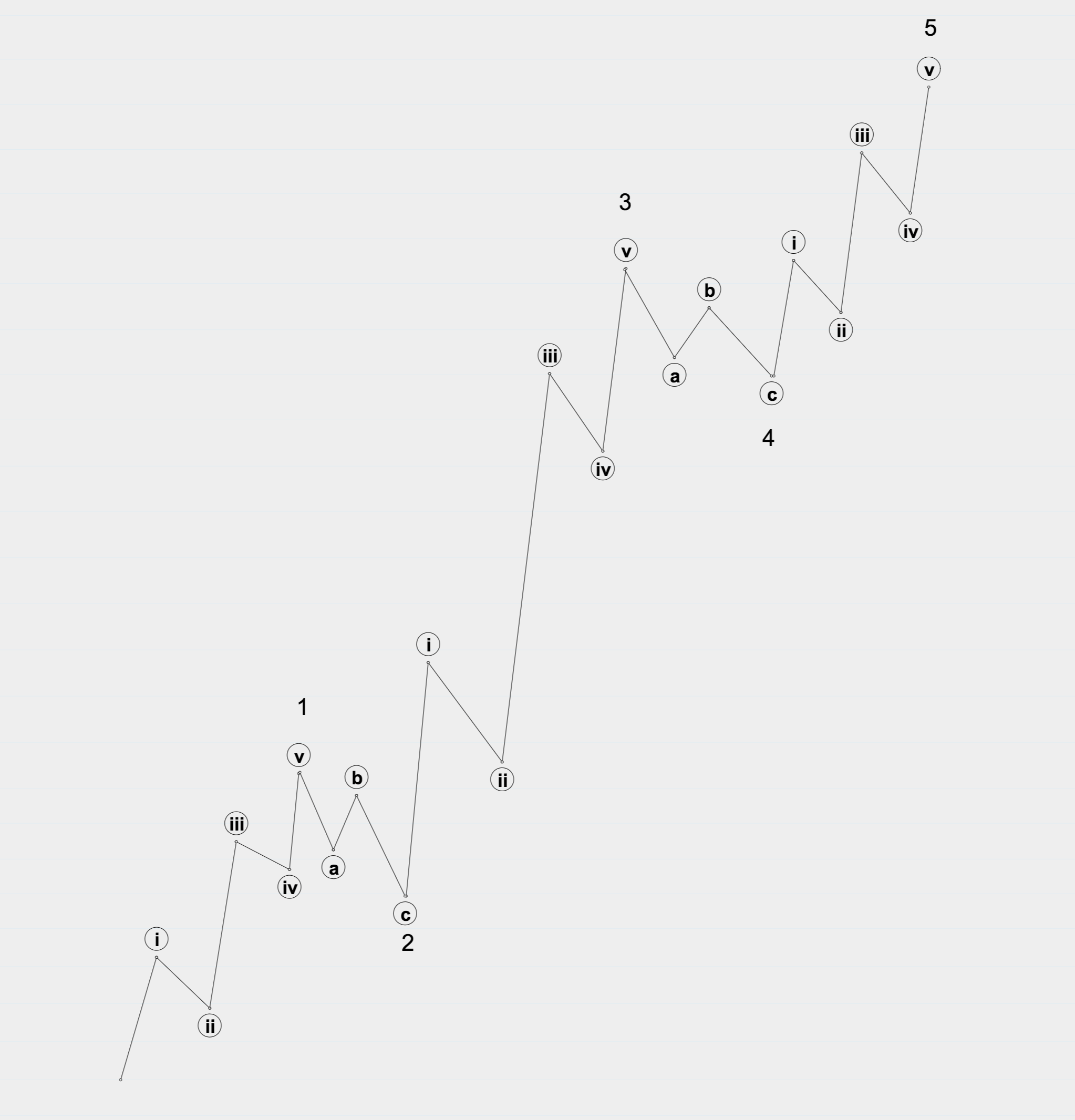

- An impulse subdivides into 5 waves

- Wave 2 cannot retrace more than 100% of wave 1

- Wave 3 cannot be the shortest of the three action waves, 1,3, and 5

- Wave 3 is always an impulse

- Wave 4 does not overlap with wave 1

- Wave 2 is never a triangle

Guidelines

- Corrective waves 2 and 4 show a different correction pattern (alternation)

- Wave 2 usually retraces a big proportion of wave 1 retracement (Fibonacci 50% – 61.8%)

- If wave 2 traces more than a 78.6% correction it is likely something else

- Wave 2 develops most often into a simple pattern

- Wave 2 develops as a zig-zag or as a combination, which includes a zig-zag

- Wave 4 shows usually a complex pattern

- Wave 4 is usually shallow (Fibonacci 23.6%-38.2%) and often ends around the 4th wave of lesser degree

- If wave 4 goes beyond Fibonacci 50% it is usually not the 4th wave

- Almost always one of waves 1,3, or 5 extend

- Usually, wave 3 extends

- The middle portion of wave 3 is usually the strongest and consists of most extensions

- 161.8% and 261.8% tend to get targeted during extensions

- Non-extended waves tend to be related by equality or Fibonacci proportions

- Extended 5th waves usually equal to the sum of waves 1 and 3

- Wave 4 often corrects the entire impulse into a proper look regarding time and price

- Wave 3 is usually extended if wave 1 is a leading diagonal

- The very rare event of a truncation (or failed fifth) occurs if wave 5 fails to pass beyond the end of wave 3

- Wave 5 is unlikely to be a diagonal if wave 3 is not extended

- Truncated 5th waves, as well as 5th wave extensions, usually cause substantial reversals