Nokia lost its crown as the world’s largest mobile phone manufacturer a while ago. They failed to adapt to changing circumstances as Apple launched the iPhone in 2007. Instead, Nokia continued investing in its proprietary Symbian platform. Meanwhile, the market leader got squeezed from the bottom end of the market as low-cost Asian manufacturers such as Huawei and HTC launched Android-based smartphones very successfully. Apple, Samsung, and others took over the top spot in high-end devices. Nokia got it terribly wrong and went from number one to become just an irrelevant market player.

Today’s situation in global markets is somewhat similar. It is characterized by opposing opinions among market participants. Cyclically sensitive commodities are priced for an entirely different economic scenario than U.S. equities. Cyclical commodities sold-off sharply from their recovery highs in January 2020. Crude recorded a drop of roughly 25% and copper lost about 12% during recent weeks. On the other end of the spectrum, U.S. equities and especially the tech sector are celebrating a party on their own. The most recent turbulences got shrugged off while market participants extrapolate the longest bull market in history.

The coronavirus outbreak was most likely the straw that broke the camel’s back. It has distinct similarities to the subprime crisis in 2007. There is a general sense of public distrust as Chinese censorship and disinformation triggered fear during the past few weeks. The reaction to the virus may have been exaggerated as pictures of empty streets in Chinese metropoles reveal. Last Friday, there have been unofficial reports from different sources that Shenzhen gets locked down. It is one of the most important commercial centers of the electronics industry worldwide. Regardless of being exaggerated or reasonable, the most recent events have a negative impact on global economic activity. China has been an essential contributor to worldwide growth and general distrust makes things worse than they are.

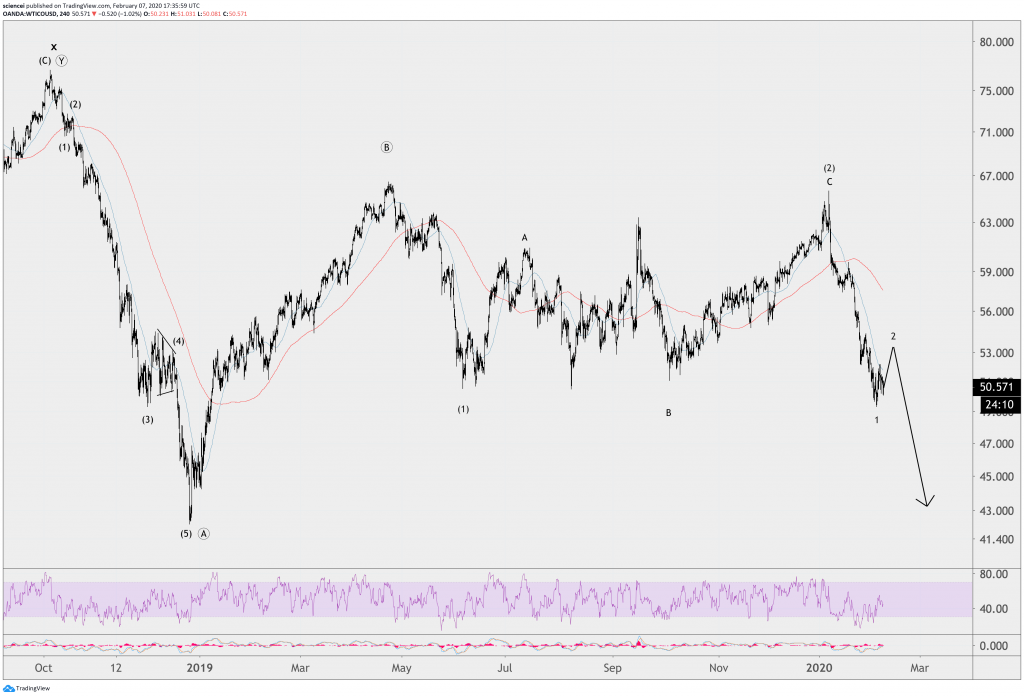

WTI crude sold off just at the time as sentiment among traders shifted into bullish territory. Its January 2020 recovery high remained below the highest level in 2019. Most likely, a corrective trend ended in 2019 and reversed to the downside. Recent strength was probably just a failed retest, which turned prices sharply lower. That interpretation finds support if we take a closer look at the sister contract – brent. Brent crude oil broke the positive trend spanning back all the way to its 2016 low during the past few weeks. WTI will probably follow on a similar path despite short-term recovery potential. Both crude contracts are most likely inside a bearish third wave within the Elliott wave framework, which implies that a short-term recovery resolves in a sharp sell-off.

Copper confirms the overall picture in crude and has suffered significant losses as well lately. The industrial metal never recovered from the global financial crisis in 2009. Most recently, it is retesting the support of its upside trend as the economic expansion matures. Copper unfolded a series of lower lows and lower highs from 2018 as well. Another sell-off in crude will most likely send copper through its long-term trend support. Selling pressure is likely to climax in that case as technically oriented traders realize that the bullish trend ended

The bottom line is that the reflation trade is most likely postponed. Cyclically sensitive commodities are probably going to follow-through on the downside instead. This conclusion does not come as a surprise. It is in line with the macro outlook that we discussed here recently.