Liquidity Drains

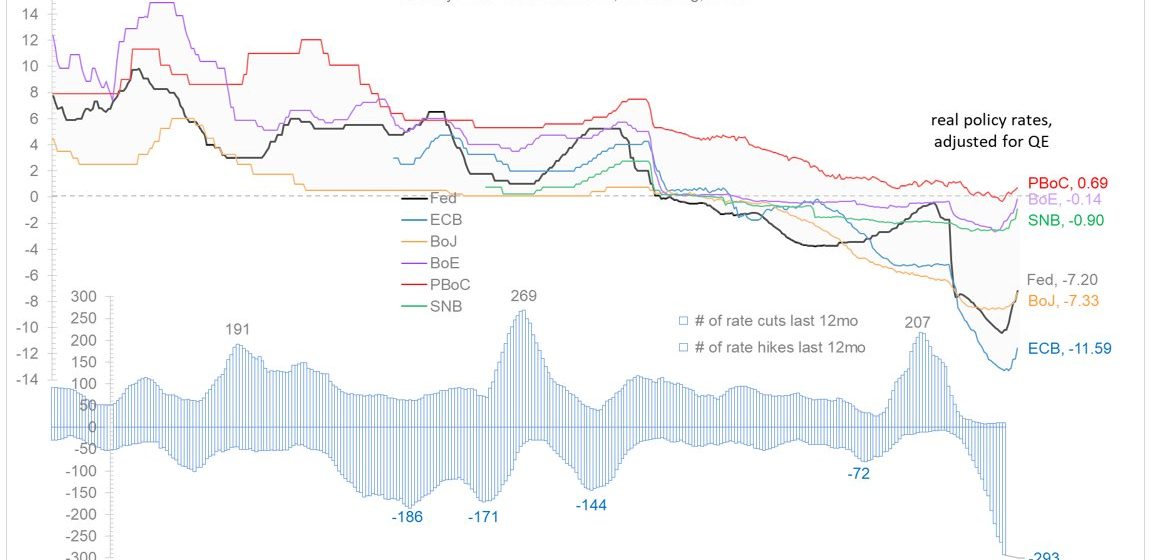

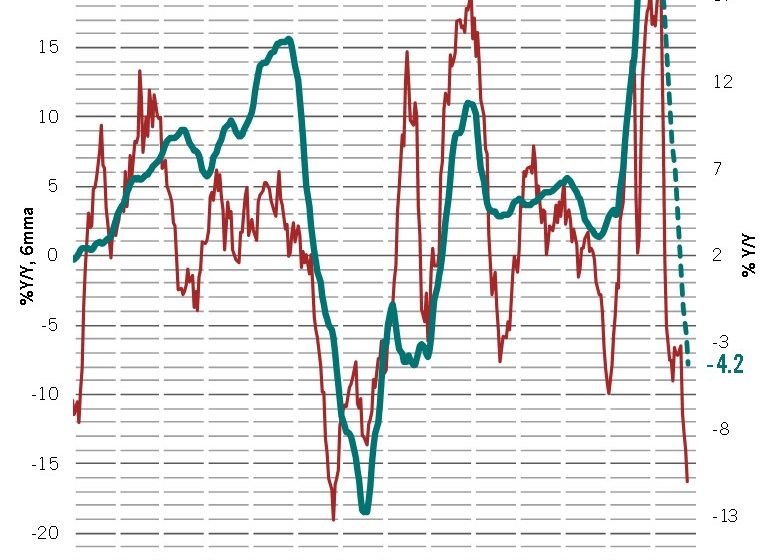

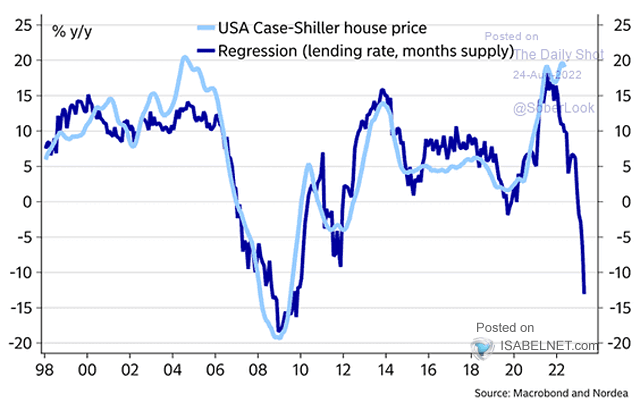

Jay Powell surprised investors yesterday. The market interpreted his comments adversely after the fed raised interest rates again by another 75bp. Instead of pivoting dovish, the fed has turned even more hawkish. The step came on top of a substantial global tightening trend. There have been about 300 rate hikes across the globe over the …