Multiple leading indicators flash recession signals. The yield curve has been inverted, credit spreads widened, and the labor market cooled down. Their lead time from cycle peak to the next recession has been historically a few months.

However, the process has been ongoing already. Moreover, the leading indicators could be even late this time as GDP already contracted in the first two quarters of 2022.

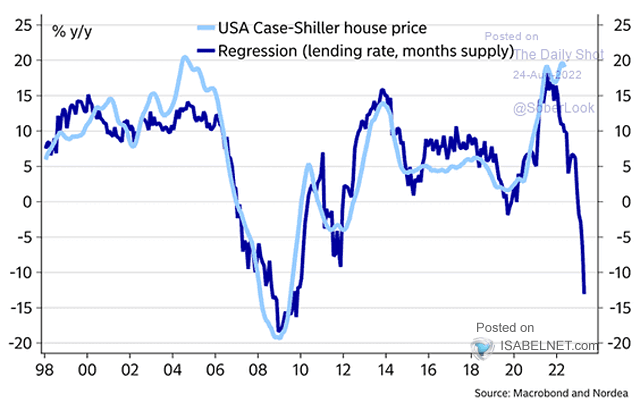

Unfortunately, leading indicators for the housing sector align on the same side of the ledger and paint a grim picture. Among a few others, one example is regressing liquidity and rates to home prices. The metric from Nordea, which was published by Isabelnet and The Daily Shot, concludes significantly more downside for housing if history were to rhyme with the current situation.

Housing is typically a significant component of total household wealth. Not surprisingly, many severe recessions came along with declines in housing activity during the past century.