US GDP contracted in both Q1/2022 and Q2/2022. According to Lakshman Achuthan’s data, there has always been a recession on the back of two quarters of negative growth in the past 75 years.

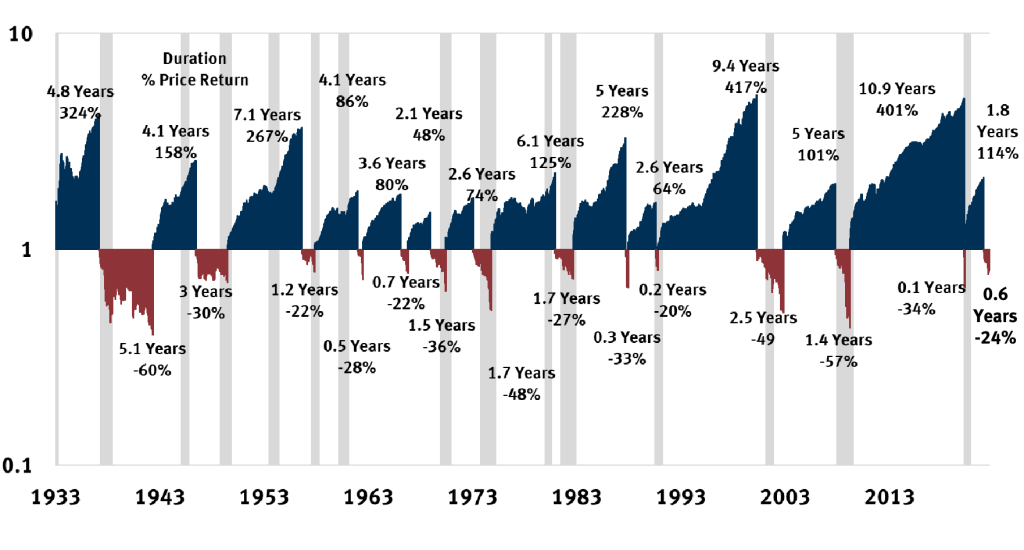

Moreover, our analysis reveals that every NBER recession in the US also triggered a double-digit decline during that same period. The stock market corrected on average -31% around post-Great Depression recessions.

NBER has not officially called a recession in 2022 because they consider multiple factors besides GDP growth. However, that does not guarantee that they won’t. Additionally, we don’t know how prolonged and severe a potential recession could unfold.

However, US equities are probably in the first half of a bear market if history rhymes again and a recession get’s confirmed after all. None of the past century’s bear markets, which coincided with an economic recession, ended in less than one year.

Chart source: Markets & Mayhem