Risky assets unfolded a sharp rebound over the past week. The major U.S. equity indices rallied by more than 20% off their most recent lows. Market participants, professional and retail, piled into the market and bought everything they could. Last evening, a WSJ headline declared the shortest bear market ever as finished after a 20% run off the most recent lows.

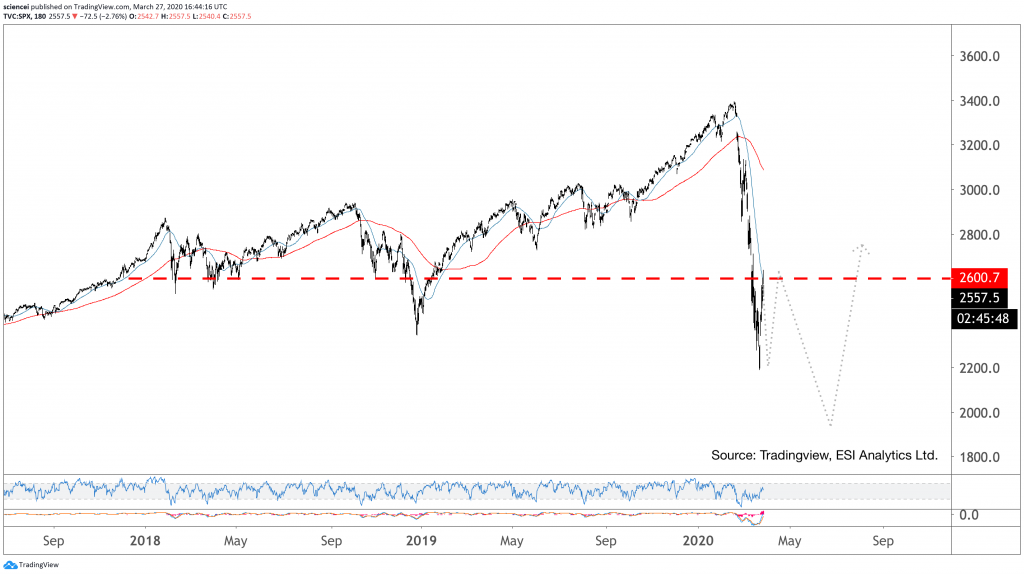

Did you buy that dip and enjoy the ride? Those who followed us here know that our latest article suggested to be patient and buy the dip as we expected the S&P 500 to dive beneath its 2018 low. It might be reasonable to take some profits at this junction, depending on your personal goals.

U.S. equities are likely to extend to the downside before the 2009 bull run stretches its final leg to the upside. Nevertheless, the magnitude of last week’s rally justifies questioning if the final bull run started already.

Behavioral and technical evidence suggests another attack on last Monday’s low. The witnessed selloff severity of the past few weeks has never formed a cyclical low during the past 150 years – not even in bull markets. That hints toward a second half-time of the match ahead. Moreover, we have observed a big reversal in sentiment during the past month. It triggered panic selling and liquidations. However, we have probably not seen capitulation yet. Most sentiment readings hit negative territory, which led to a larger degree reversal historically. That did not happen in a hit-and-run manner. Historically, negative sentiment readings persisted for a few weeks until a reversal unfolded eventually. Therefore, behavioral and technical evidence favor another leg to the downside before the correction ends.

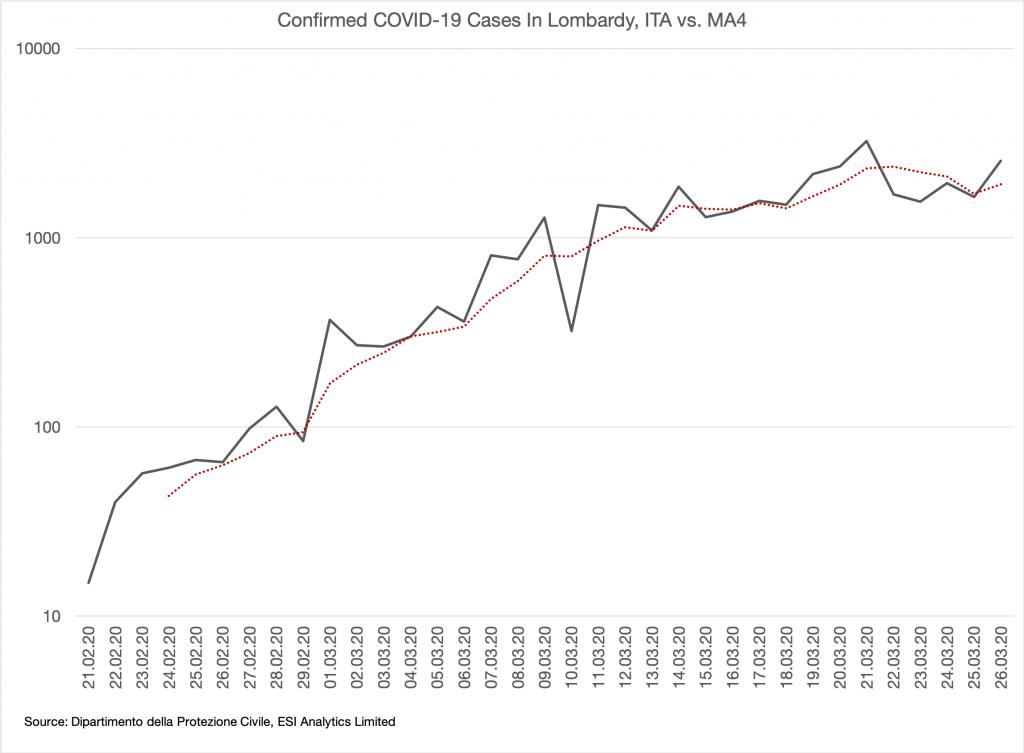

The coronavirus pandemic remains the dominating narrative. South Korea, Singapore, and Taiwan laid out an example of how to control the virus. There is evidence that social distancing measures work in other countries as well. Germany, for example, is on the best path to flatten their COVID-19 growth rate by adopting many measures from South Korea. America is getting severely hit by the pandemic and New York evolved as an epicenter of the outbreak. However, it is not too late to contain the spread with effective measures. The chart below is from the Lombardy area in Italy, which is by far the hardest-hit Italian area. It reveals that infections are stabilizing instead of growing exponentially. Moreover, it is important to stress that very close family bonds characterize Italian culture. Multiple generations live either under the same roof or nearby. They have daily contact, embrace, kiss each other’s cheeks, and are as socially close as it gets. Nonetheless, social distancing measures seem to work even among the most extreme example witnessed so far.

Hence, evidence shows that the pandemic can be contained and economic activity can recover after a few weeks. Meanwhile, we witness broad-based government intervention to rescue the economy. That trend is likely to continue as fiscal and monetary policy mutated to an institutionalized buy-the-dip across the globe. Some of the measures are the same that were used to mitigate the financial crisis in 2007-2009. Hence, corporations and the financial system get supported again today. It will most likely lead to a substantial recovery in the stock market at some point.

Fundamentals favor a resolution to the upside. Therefore, they contradict the technical and behavioral side of the story. What is the best strategy for this kind of scenario? Behavioral and technical signals have the best track record short-term. Hence, the base case is another leg down. However, the story turns upside down if we witness a sustained complementary break above 8,000 in the Nasdaq 100 and 2,620 in the S&P 500. That turns technicals positive and therefore creates an overweight toward bullish arguments.

The bottom line is that a retest of the most recent lows is likely unless the S&P 500 and Nasdaq can sustainably break above 2,620 and 8,000, respectively.