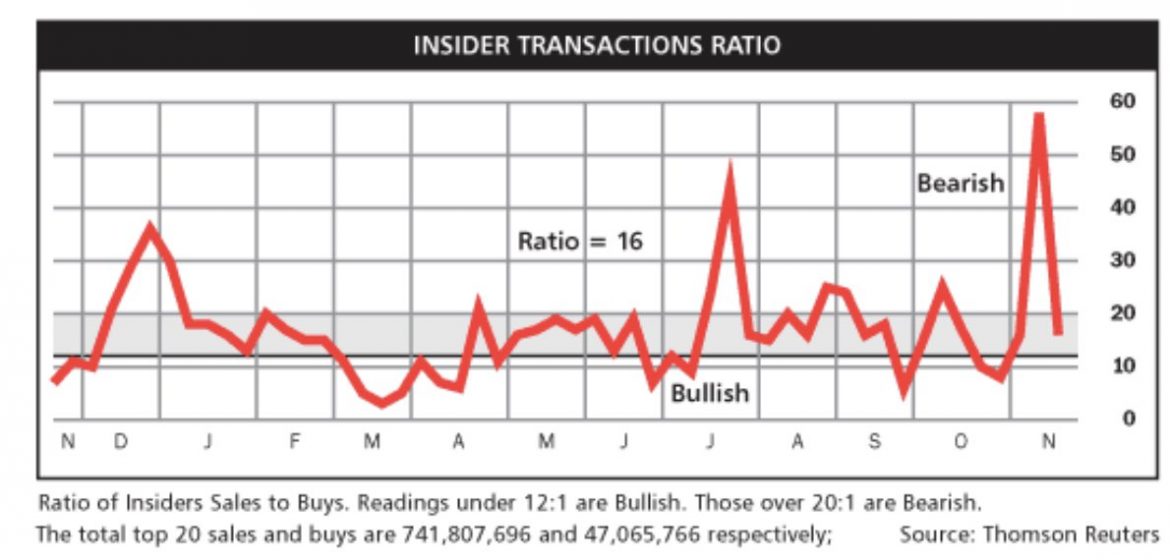

CEO’s Don’t Buy The Recovery

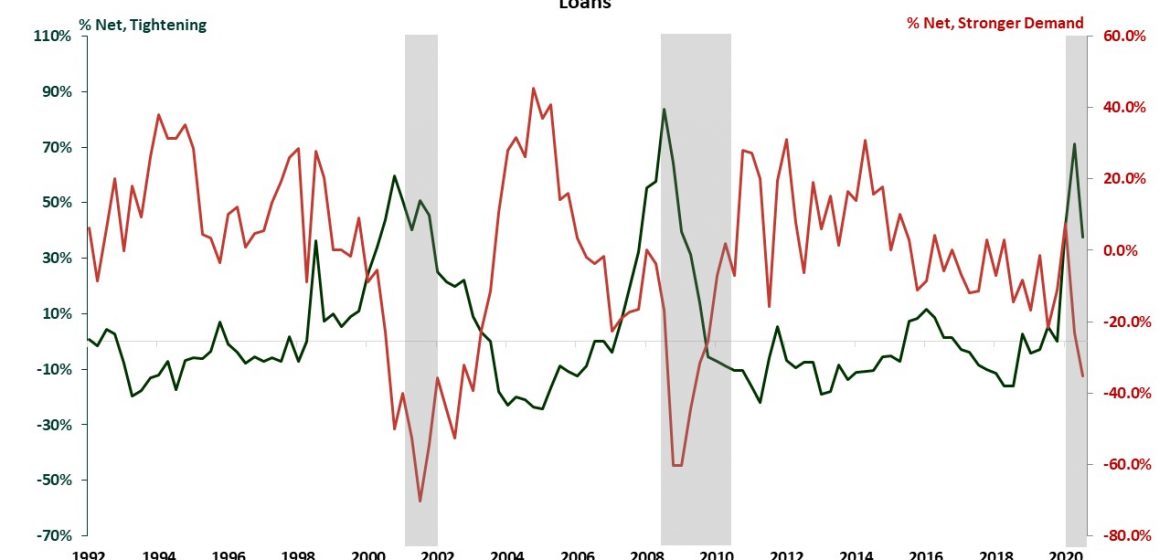

Entrepreneurs and senior managers don’t believe that the rebound is sustainable. Soft and hard facts hint to that conclusion. CEO’s sentiment has been softening most recently. Their outlook for the next twelve months deteriorated significantly in November. Moreover, the demand for commercial and industrial loans has not recovered yet. Credit growth typically signals that the private sector …