Equities decoupled from the underlying macro data. Many thought that the corona crash could fix that, but it didn’t. Valuations became even more expensive instead. Several reliable indicators are as stretched as they have never been before. An example is the composite market value relative to GDP. It stands at more than double the US GDP and is 75% above its long-term trend. The big question is not if equities reverse to the mean but rather when it happens.

Admittedly, a record amount of liquidity keeps on flowing into equities, regardless of fundamentals. The fear of missing out feeds an asset bubble. Historically, it did not take long once investors used margin and call options to chase loss-making companies without considering fundamentals. Today, investors bank on the fed put and think policymakers will ensure that asset prices develop favorably.

(Source: Advisor Perspectives)

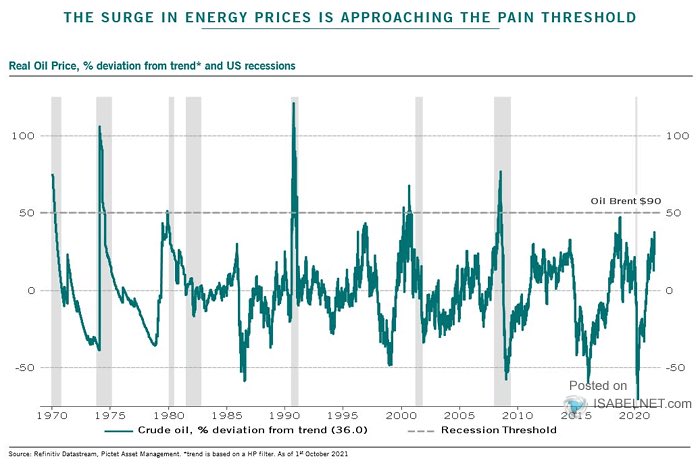

So far, consumers have mainly experienced an energy price shock and rising prices due to pent-up demand. What would happen if energy prices keep on increasing or if food prices surge along with the energy complex? Inflation-adjusted crude oil prices are very close to a typical threshold shortly before recessions during the past few decades. Rising inflation expectations, record negative real interest rates, record valuations, and a breakdown of supply chains are substantial challenges for central banks. Monetary policymakers have no control over commodity prices and supply chains. Moreover, no industrialized economy can afford higher interest rates right now. Therefore, policymakers are likely trapped and heading into a dead end. Adding that to record high equity valuations and record-high household equity allocations has only one implication: Equity investors will be disappointed in the next decade. There is no need for a crystal ball to anticipate that.

(Source: Pictet Asset Management, Isabelnet)

Nonetheless, we are probably not at the end of the bull run just yet. The market is most likely not done to the upside despite a likely 5%-10% correction short-term. Momentum remains the crucial factor short-term. The equity rally was solid and broad-based during October. Most often, similar conditions resulted in upside continuation historically. However, the most recent advance has been already substantial and started diverging on more minor scales. Moreover, the S&P 500 traded into its long-term trend resistance. Sentiment spiked up at the same time as investors counted their chickens before they hatched. Currently, there is a lot of greed in the market. Moreover, mood swings are extraordinarily sharp in both directions. The NAAIM index is one example that quantifies the current investor sentiment. Active investment managers are among other cohorts very bullish, as the index shows. Record low put/call ratios, low VIX regimes, etc. confirm that picture and are a mid-term risk for equities.

(Source: National Association of Active Investment Managers)

The market will most likely push higher during the next three to six months. However, a cold shower will probably disenchant investors first. Some form of consolidation remains most likely before the next sustainable rally begins. A shallow correction would fit best and lead to a retest of the 4300-4400 area in the S&P 500 short-term. Subsequently, at least a final leg higher carries the index towards 4900-5000.

All in all, bulls hold the ball firmly in their hands. That’s valid as long as 4300 does not break down sustainably on the S&P 500. However, it may take time until we see progress to the upside on the S&P 500. A volatile sideways market that resolves to the upside remains the most likely scenario.